nh food tax rate

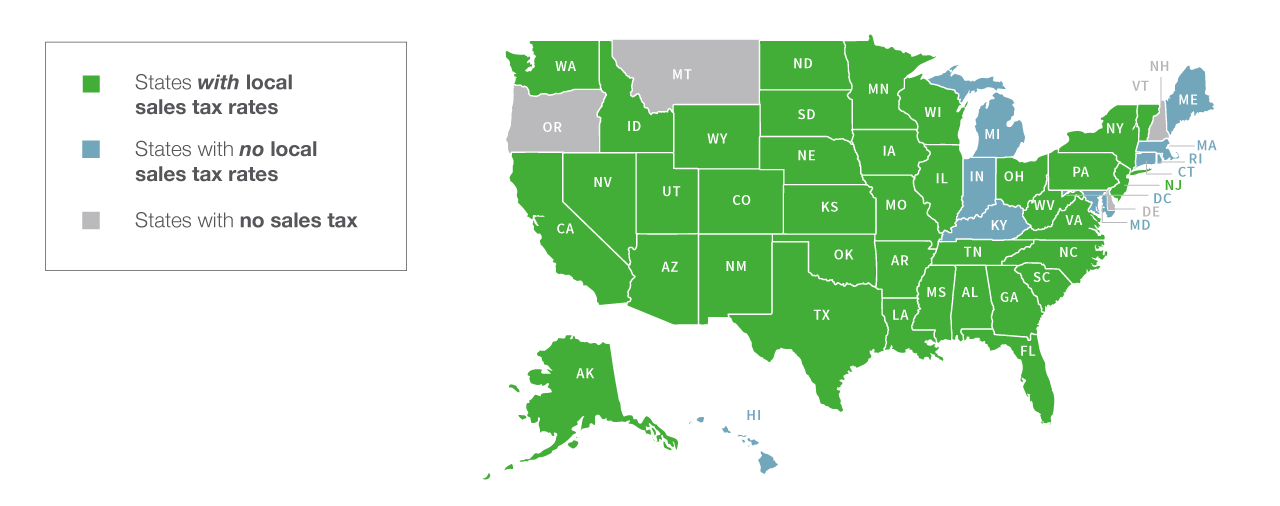

B Three states levy mandatory statewide local add-on sales taxes. All documents have been saved in Portable Document Format unless otherwise indicated.

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

The 2021 tax rate for Londonderry is 1838 per 1000.

. Town of Rindge NH 30 Payson Hill Road Rindge. Skip to main content. Website Disclaimer Government Websites by CivicPlus.

Some rates might be different in Portsmouth. Completed Public Tax Rates 2021 Final. Visit nhgov for a list of free csv readers for a variety of operating systems.

A 9 tax is also assessed on motor vehicle rentals. PO Box 23 Ctr. Year Rate Assessed Ratio.

Chapter 144 Laws of 2009 increased the rate from 8 to the current rate of 9 and added campsites to the definition of hotel. The Tax Rate for 2021 is 2245The Equalization Rate is 911. The state meals and rooms tax is dropping from 9 to 85.

Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090. Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forward. Start filing your tax return now.

TAX DAY NOW MAY 17th - There are -444 days left until taxes are due. 12 Mountain View Drive Strafford NH 03884. A net rate of 17 is now allocated as 04 AC and 13 UI.

The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Other taxes in New Hampshire include a cigarette tax a gas tax and an excise tax on beer.

New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2021 Municipality Date Valuation w Utils Total Commitment 1 000 000 000 000 000 Dorchester 111721 45178890 989433 Dover 120121 4472310130 95862031. Food Service guidance issued on May 18 2020.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. State of New Hampshire and the Towns of Hampton North Hampton Rye Seabrook and New Castle to operate seacoast beaches during the COVID-19 pandemic.

How 2021 sales taxes are calculated in new hampshire. Town of Amherst 2 Main Street Amherst NH 03031 603-673-6041. Detailed New Hampshire state income tax rates and brackets are available on this page.

Prepared Food is subject to special sales tax rates under New Hampshire law. A 9 tax is also assessed on motor vehicle rentals. Gail Stout 603 673-6041 ext.

For additional assistance please call the Department of Revenue Administration at 603 230-5920. New Hampshires sales tax rates for commonly exempted categories are listed below. Eqkdqb7mjbevtm to ensure a smooth transition to the new tax rate we are.

Consolidated Communication Updates. 44 rows Annual Tax Rate Determination Letters mailed by September 1 2022 for the tax period 712022 Q32022 through 6302023 Q22023. Keywords Contact Us Subscribe to Alerts.

The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Official NH DHHS COVID-19 Update 34b.

About About. Comma Separated Values csv format. Nh food tax rate.

This set annually in October by the Department of Revenue. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. The meals and rentals mr tax was enacted in 1967 at a rate of 5.

There are however several specific taxes levied on particular services or products. Motor vehicle fees other than the Motor. Free Excel reader from Microsoft.

1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb. Nh food tax rate Friday March 25 2022 Edit. Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives For an up-to-date list of.

Employers can view their current and prior quarter tax rates on our WEBTAX System. For additional assistance please call the Department of Revenue Administration at 603 230-5920. 2021 Tax Rate Comparison.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. In 2010 campsites were removed.

New Hampshire Sales Tax Handbook 2022

New Hampshire Income Tax Calculator Smartasset

New Hampshire Income Tax Calculator Smartasset

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

New Hampshire Meals And Rooms Tax Rate Cut Begins

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

New Hampshire Sales Tax Rate 2022

Understanding New Hampshire Taxes Free State Project

How Do State And Local Sales Taxes Work Tax Policy Center

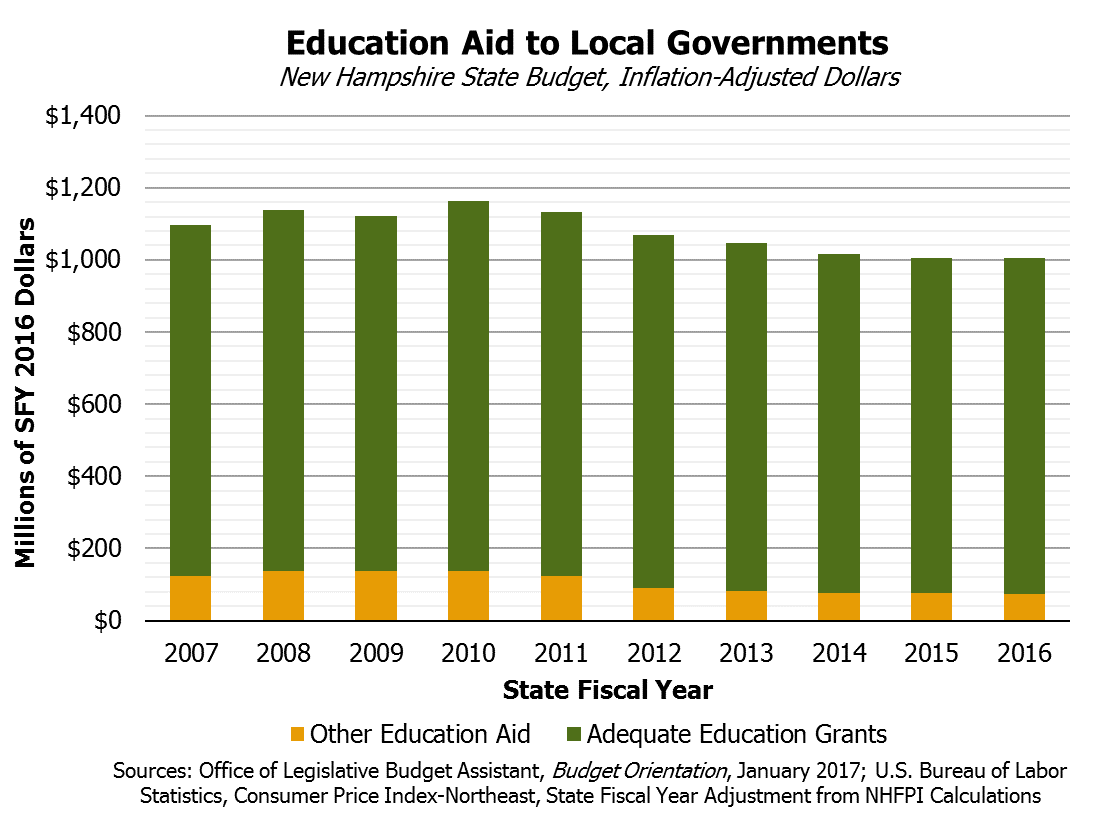

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Timber Basis Decision Model A Calculator To Aid In Federal Timber Tax Related Decisions Extension